Performance, flexibilité et sécurité pour votre infrastructure

Externalisez votre informatique en toute sérénité avec TAS Cloud Services. Hébergeur infogérant cloud de proximité, nous vous accompagnons à chaque étape pour vous permettre de bénéficier d’une solution parfaitement adaptée à vos besoins IT.

Votre hébergeur de proximité

A Sophia-Antipolis, France

Découvrez nos offres Startup

Développez votre startup avec des solutions d'hébergement cloud locales, flexibles et évolutives ! Profitez de notre tarification spécialement conçue pour les startups, débutant avec des coûts réduits et augmentant progressivement en phase avec votre croissance.

Une infogérance complète gratuite pendant 2 ans : Concentrez-vous sur votre business, nous gérons votre IT.

Ils nous font confiance

Vos données, hébergées au bon endroit, disponibles à tout moment

Nous soulageons votre entreprise de ses problèmes d’infrastructure informatique pour vous permettre de vous concentrer sur ce qui compte le plus pour vous : votre coeur de métier.

Assurez une meilleure disponibilité à vos données

Renforcez la sécurité de votre infrastructure IT

Gagnez en performances

Faites le choix de la proximité

Cloud

Optez pour l'agilité et la flexibilité grâce nos solutions Cloud

Nous vous proposons des services de type IaaS et PaaS (containers et/ou VM) pour vous permettre de bénéficier d’une architecture flexible, capable de s’adapter à toute exigence accrue de volumes de stockage, de puissance de traitement et de débit.

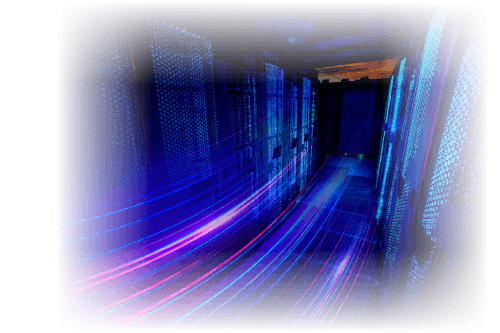

Hébergement

Externalisez votre informatique en toute simplicité

En hébergeant votre informatique au sein de notre datacenter, vous bénéficierez des meilleures technologies et gagnerez en performances, en disponibilité et en sécurité, le tout avec le soutien et le suivi de nos experts en solutions IT.

Professionnalisme et expérience au service de votre infrastructure IT

Les infrastructures informatiques vieillissent, deviennent coûteuses à maintenir et perdent en performance au fil du temps. Pour solutionner ce problème pour le bon fonctionnement de ses propres services, TAS a fait le choix de créer une unité experte, spécialement dédiée à la gestion de serveurs. Cette unité, c’est TAS Cloud Services, qui accompagne les entreprises dans l’externalisation de leurs systèmes d’information depuis plus de 25 ans.

Nos partenaires

Votre hébergeur de proximité, à Sophia-Antipolis

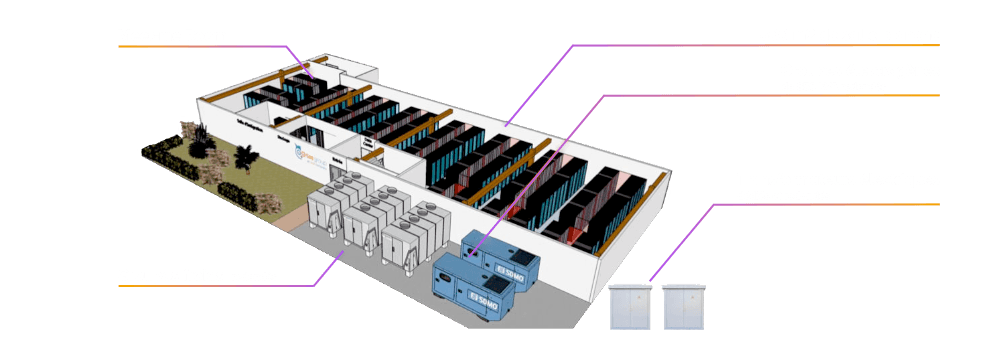

Un datacenter moderne, de niveau Tier 4, pour une disponibilité garantie de service de 99,99%

Situé au coeur de la technopole de Sophia Antipolis, en France, notre datacenter de 850 m2 bénéficie des technologies les plus avancées. Son coefficient d’efficacité énergétique (PUE) de 1,25 le place parmi les meilleurs au monde. Nos systèmes de détection et d'extinction des incendies sont conformes, certifiés aux normes APSAD et AFNOR et répondent aux exigences les plus élevées de ces deux normes.

Redondance, continuité de service, présence locale et couverture internationale

Toute notre alimentation électrique est doublée : transformateurs EDF, onduleurs, groupes électrogènes. Chaque baie dispose également de 2 disjoncteurs.

Nos installations bénéficient d’une régulation thermique et hygrométrique. La température y est constante à + ou - 10% 24 heures sur 24, 7 jours sur 7.

Nous avons mis en place des protocoles de sécurité de très haut niveau pour prévenir tous types de risques : intrusions, sismique, incendie, eau, air, accès...

Une infrastructure multi-sites, un réseau international

Nous avons mis en place une infrastructure redondante et développé plusieurs points de présence pour permettre une disponibilité optimale des données hébergées dans notre datacenter. Les temps de latence sont ainsi très fortement réduits, à la fois pour l’Europe et la zone Amérique.

Contactez-nous

Nous sommes là pour répondre à toutes vos questions et demandes de renseignements.

Discutons dès maintenant de votre projet

Contactez-nous par téléphone au 04.92.94.56.72 ou réservez un appel avec l'un de nos experts TAS Cloud Services.

Recevez notre veille sur l’actualité cloud / IT

La veille technologique est primordiale dans notre industrie. Nous vous faisons bénéficier des dernières actualités en la matière. Abonnez-vous à notre newsletter pour les recevoir chaque mois dans votre boîte e-mail.

S'inscrire à notre newsletter

Votre hébergeur de proximité

A Sophia-Antipolis, France